The audit opinion on the annual consolidated financial statement of the state (ACFSS) published by the State Audit Office is qualified as previously. Following concerns expressed by the State Audit Office last year about a potential disclaimer of opinion, this ACFSS shows improvements that allow the public and investors to have a more accurate and precise notion of the performance and financial condition of the state and hope for a possible affirmative opinion in the future. However, for this to happen, one must finish the property inventory in Riga and Jurmala City Municipalities, clarify and estimate potential liabilities from Latvia’s membership in international organisations, introduce the accrual principle in revenue accounting, and eliminate other discrepancies.

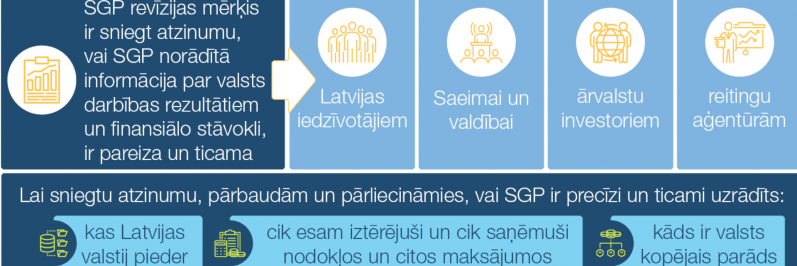

The ACFSS drafted by the Ministry of Finance provides information on the performance and financial position of the state as of 31 December every year. When auditing the ACFSS, the State Audit Office aims at giving an opinion to the people of Latvia, the Saeima, and the government, and foreign investors and rating agencies on whether the information provided in the ACFSS is correct and reliable.

As in previous years, the State Audit Office could not obtain sufficient assurance that the value of 1.2 billion euros of long-term investments presented in the ACFSS had been determined correctly, as 80% of this value referred to Riga and Jurmala municipal transport structures. For a long time, both local governments have not carried out a full inventory of transport structures.

This year, one was required to report liabilities for post-employment benefits in the ACFSS for the first time such as service pensions and the benefits for dismissed heads of local or regional governments. As the State Treasury had not established clear and comprehensible procedures for calculating and presenting post-employment benefits for a long time, the public institutions had considerable uncertainty in preparing their annual financial statements. Only thanks to the active engagement of the State Audit Office in the ACFSS, calculating additional liabilities for service pensions of 1.4 billion euros was possible. Therefore, the State Audit Office has called on the State Treasury to improve the explanatory materials of accounting significantly so that it would be clear at last how to calculate accruals for post-employment benefits, which institution should calculate them and present them in the annual financial statement, and what costs the state budget should take into account in the future.

The amount of future liabilities assumed by the state for the payment of service pensions has already reached at least 4 billion euros. In May 2020, when completing the financial audits of ministries and central state institutions of 2019, the State Audit Office already reminded and emphasised that there were doubts about the ability of budget revenues to cover that expenditure in the future without reviewing the existing service pensions and expanding the range of service pension recipients.

In this audit, we also draw attention to potential liabilities from Latvia’s membership in international organisations. The audit has revealed that no institution collects information on all international organisations where Latvia is a member state. Publicly available information is incomplete and even misleading. Latvia’s membership in international organisations means not only the implementation of the national foreign policy goals but also relevant state budget expenditure and liabilities, including for covering the post-employment benefits of the organisations. Therefore, identifying the extent of Latvia’s membership in international organisations is crucial for estimating and indicating all liabilities in the ACFSS.

While auditing the ACFSS, the State Audit Office considered five compliance issues by checking whether the funding was spent following the purpose and the actions complied with laws and regulations. Unqualified opinions were issued on the use of funding allocated for the celebration of the Centenary of Latvia, on the activities of local and regional governments in updating the documents of the accounting organisation and on the taxpayer support measures by drawing attention to individual discrepancies. An unqualified opinion was issued on the implementation of a CCTV system at customs control points.

The State Audit Office has refused to provide an opinion on one of the five compliance issues, namely, the use of funding for the project “Ensuring the Standardisation of Financial Accounting Processes in State and Municipal Institutions” implemented by the State Treasury because the deficiencies identified in the project do not allow gaining sufficient evidence and verification of the achievement the deliverables of the project. The project should have provided the harmonisation and standardisation of accounting processes by improving the quality of financial data. Project management and monitoring have not been carried out responsibly, as direct and indirect costs of the project have not been recorded, training has been poorly organised, the results defined in the project have not been reliable and justified, and other significant deficiencies have been identified.

In general, when assessing the ACFSS, the State Audit Office positively notes the improvements made because one has classified the South Bridge liabilities correctly at last and has improved the property accounting.

There is a separate interim report drafted on the identified deficiencies in Saulkrasti Regional Government during the audit with the recommendations provided for elimination thereof and a case study report elaborated on the information and communication technology environment in local and regional governments while preparing for administrative and territorial reform that is sent to the Ministry of Environmental Protection and Regional Development.